Schnellzugriff

- Direkt zur Sitemap

- Direkt zur Suche

- Direkt zur Startseite

- Direkt zu Zugang für Alle

- Direkt zur Navigation

- Direkt zum Inhalt

- Direkt zum Kontakt

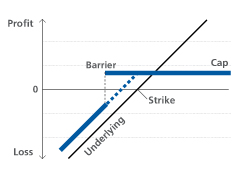

Product type number as specified by the Swiss Structured Products Association (SSPA): 1210

Please consult the termsheet and the accompanying issue prospectus for information on the exact product functionality, product details and risks.

| Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 | |

|---|---|---|---|---|

| Description | Rising underlying | Slightly rising underlying | Slightly falling underlying | Falling underlying |

| Underlying value | share X | share X | share X | share X |

| Cap Level | 110% | 110% | 110% | 110% |

| Knock-in Level (Barrier) | 80% | 80% | 80% | 80% |

| Capital employed | CHF 10'000 (100 certificates) | CHF 10'000 (100 certificates) | CHF 10'000 (100 certificates) | CHF 10'000 (100 certificates) |

| Term | 1 year | 1 year | 1 year | 1 year |

| Issue price | 100% | 100% | 100% | 100% |

| Ratio | 1 | 1 | 1 | 1 |

| Share X at initial fixing | CHF 110 | CHF 110 | CHF 110 | CHF 110 |

| Share X at maturity | CHF 132 | CHF 122.20 | CHF 99 | CHF 88 |

| Barrier breached? | No | Yes | No | Yes |

| Performance share X | 20% | 2% | -10% | -20% |

| Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 (physical delivery) | |

|---|---|---|---|---|

| Calculation | 100 certificates * 110 (Cap) | 100 certificates * 110 (Cap) | 100 certificates * 110 (Cap) | 100 certificates * 90 (equivalent value) |

| Redemption | CHF 11'000 | CHF 11'000 | CHF 11'000 | CHF 9'000 |

| Profit / Loss | 10% | 10% | 10% | -10% |

| Swiss income tax | Term <1 year: free of tax

Term >1 year: Predominantly one-off interest payments (IUP)

|

|---|---|

| Swiss withholding tax | No |

| Swiss stamp tax | Yes (if physical delivery / term > 1 year) |

| EU tax on interest | No |

| ZKB Autocallable Barrier Reverse Convertible on worst of adidas AG/Nike Inc/Under Armour Inc 142529760 / CH1425297608 |

| ZKB Barrier Reverse Convertible on worst of adidas AG/Nike Inc/Under Armour Inc 140252445 / CH1402524453 |

| ZKB Barrier Reverse Convertible on worst of adidas AG/Nike Inc/Under Armour Inc 142529680 / CH1425296808 |

| ZKB Barrier Reverse Convertible on worst of adidas AG/Nike Inc/Under Armour Inc 142530063 / CH1425300634 |

| ZKB Autocallable Barrier Reverse Convertible auf Under Armour Inc 142529772 / CH1425297723 |