Schnellzugriff

- Direkt zur Sitemap

- Direkt zur Suche

- Direkt zur Startseite

- Direkt zu Zugang für Alle

- Direkt zur Navigation

- Direkt zum Inhalt

- Direkt zum Kontakt

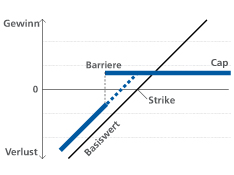

Produkttyp-Nummer gemäss Schweizerischen Verband für Strukturierte Produkte (SVSP): 1210

Die genaue Funktionsweise, Produktdetails und Risiken entnehmen Sie bitte dem Termsheet und dem dazugehörigen Emissionsprogramm.

| Szenario 1 | Szenario 2 | Szenario 3 | Szenario 4 | |

|---|---|---|---|---|

| Beschreibung | Steigende Kurse | Leicht steigende Kurse | Leicht fallende Kurse | Fallende Kurse |

| Basiswert | Aktie X | Aktie X | Aktie X | Aktie X |

| Cap Level | 110% | 110% | 110% | 110% |

| Knock-in Level (Barriere) | 80% | 80% | 80% | 80% |

| Eingesetztes Kapital | CHF 10'000 (100 Zertifikate) | CHF 10'000 (100 Zertifikate) | CHF 10'000 (100 Zertifikate) | CHF 10'000 (100 Zertifikate) |

| Laufzeit | 1 Jahr | 1 Jahr | 1 Jahr | 1 Jahr |

| Ausgabepreis | 100% | 100% | 100% | 100% |

| Ratio | 1 | 1 | 1 | 1 |

| Aktie X bei Emission | CHF 110 | CHF 110 | CHF 110 | CHF 110 |

| Aktie X bei Verfall | CHF 132 | CHF 122.20 | CHF 99 | CHF 88 |

| Knock-in eingetreten? | Nein | Ja | Nein | Ja |

| Aktienperformance | 20% | 2% | -10% | -20% |

| Szenario 1 | Szenario 2 | Szenario 3 | Szenario 4 (Titellieferung) | |

|---|---|---|---|---|

| Berechnung | 100 Zertifikate * 110 (Cap) | 100 Zertifikate * 110 (Cap) | 100 Zertifikate * 110 (Cap) | 100 Zertifikate * 90 (Gegenwert) |

| Rückzahlung | CHF 11'000 | CHF 11'000 | CHF 11'000 | CHF 9'000 |

| Gewinn / Verlust | 10% | 10% | 10% | -10% |

| Einkommenssteuer | Laufzeit <1 Jahr: Steuerfrei

Laufzeit >1 Jahr: Modifizierte Differenzbesteuerung (IUP)

|

|---|---|

| Verrechnungssteuer | Nein |

| Umsatzabgabe | Ja (bei Titellieferung / Überjährigkeit) |

| EU-Steuerrückbehalt | Nein |

| ZKB Autocallable Barrier Reverse Convertible on worst of adidas AG/Nike Inc/Under Armour Inc 142529760 / CH1425297608 |

| ZKB Barrier Reverse Convertible on worst of adidas AG/Nike Inc/Under Armour Inc 140252445 / CH1402524453 |

| ZKB Barrier Reverse Convertible on worst of adidas AG/Nike Inc/Under Armour Inc 142529680 / CH1425296808 |

| ZKB Barrier Reverse Convertible on worst of adidas AG/Nike Inc/Under Armour Inc 142530063 / CH1425300634 |

| ZKB Barrier Reverse Convertible auf XPeng Inc 149283220 / CH1492832204 |