Schnellzugriff

- Direkt zur Sitemap

- Direkt zur Suche

- Direkt zur Startseite

- Direkt zu Zugang für Alle

- Direkt zur Navigation

- Direkt zum Inhalt

- Direkt zum Kontakt

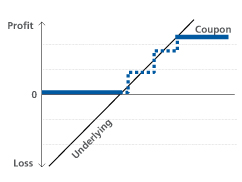

Product type number as specified by the Swiss Structured Products Association (SSPA): 1140

Please consult the termsheet and the accompanying issue prospectus for information on the exact product functionality, product details and risks.

| Scenario 1 | Scenario 2 | Scenario 3 | ||||

|---|---|---|---|---|---|---|

| Description | Rising Underlying | Rising underlying | Falling underlying | |||

| Underlying value | 6 shares | 6 shares | 6 shares | |||

| Capital protection | 100% | 100% | 100% | |||

| Minimum coupon | 1% p.a.% | 1% p.a. | 1% p.a. | |||

| Maximum coupon | 6% p.a. | 6% p.a. | 6% p.a. | |||

| Magnet effect | No | Yes | No | |||

| Yield cap p.a. | 6% | 6% | 6% | |||

| Yield floor p.a. | No | No | -10% | |||

| Term | 5 years | 5 years | 5 years | |||

| Issue price | 100% | 100% | 100% | |||

| Performance year 1 | Performance in% | Performance for calculation in% | Performance in% | Performance for calculation in% | Performance in% | Performance for calculation in% |

|---|---|---|---|---|---|---|

| Share A (weight 1/6) | +5 | +5 | +3 | +6 (Magnet) | -12 | -10 (Floor) |

| Share B (weight 1/6) | +10 | +6 (Cap) | -1 | -1 | -6 | -6 |

| Share C (weight 1/6) | +15 | +6 (Cap) | +2 | +6 (Magnet) | -30 | -10 (Floor) |

| Share D (weight 1/6) | +10 | +6 (Cap) | -0.5 | -0.5 | -2 | -2 |

| Share E (weight 1/6) | +7 | +6 (Cap) | +1 | +6 (Magnet) | -9 | -9 (Floor) |

| Share F (weight 1/6) | +20 | +6 (Cap) | -4 | -4 | -17 | -10 (Floor) |

| Scenario 1 | Scenario 2 | Scenario 3 | |

|---|---|---|---|

| Calculation | (5% + 6% + 6% + 6% + 6% + 6%) / 6 = 5.83% | (6% - 1% + 6% - 0.5% + 6% - 4%) / 6 = 2.08% | (- 10% - 6% - 10% - 2% - 9% - 10%) / 6 = -7.83% |

| Coupon after year 1 | 5.83% | 2.08% | 1.00% (minimum coupon) |

| Swiss income tax | Predominantly one-off interest payments (IUP) |

|---|---|

| Swiss withholding tax | No |

| Swiss stamp tax | Yes |

| EU tax on interest | No |

| 13.68% p.a. ZKB Callable Barrier Reverse Convertible, 27.10.2025 on worst of STMN SE/ROG SE/VACN SE ... 135804113 / CH1358041130 |

| ZKB Tracker-Zertifikat Dynamisch auf Quantum Computing 121826631 / CH1218266315 |

| ZKB Autocallable Barrier Reverse Convertible on worst of Baloise-Holding AG/Swiss Life Holding AG/Zu... 134141312 / CH1341413123 |

| 6.77% p.a. ZKB Autocallable Barrier Reverse Convertible, 29.06.2026 on worst of ROG SE/ACLN SE/VACN ... 135803455 / CH1358034556 |

| ZKB Barrier Reverse Convertible on worst of Adobe Inc/Microsoft Corp/Oracle Corp 139434217 / CH1394342179 |