Schnellzugriff

- Direkt zur Sitemap

- Direkt zur Suche

- Direkt zur Startseite

- Direkt zu Zugang für Alle

- Direkt zur Navigation

- Direkt zum Inhalt

- Direkt zum Kontakt

Product type number as specified by the Swiss Structured Products Association (SSPA): 1130

Please consult the termsheet and the accompanying issue prospectus for information on the exact product functionality, product details and risks.

| Scenario 1 | Scenario 2 | Scenario 3 | |

|---|---|---|---|

| Description | Rising underlying | Slightly rising underlying | Falling underlying |

| Underlying value | SMI® Index | SMI® Index | SMI® Index |

| Capital protection | 100% | 100% | 100% |

| Participation | 100% | 100% | 100% |

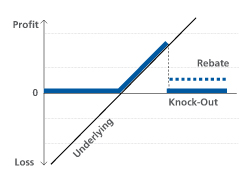

| Knock-out Level (Cap) | 124% | 124% | 124% |

| Rebate | 4% | 4% | 4% |

| Term | 2 years | 2 years | 2 years |

| Issue price | 100% | 100% | 100% |

| Capital employed | CHF 10'000 | CHF 10'000 | CHF 10'000 |

| Barrier breached? | Yes | No | No |

| SMI® at initial fixing | 8'000 points | 8'000 points | 8'000 points |

| SMI® at maturity | 8'800 points | 8'400 points | 7'200 points |

| Performance SMI® | 10% | 5% | -10% |

| Scenario 1 | Scenario 2 | Scenario 3 | |

|---|---|---|---|

| Calculation | 10'000 + (4%*10'000) | 10'000 + (5%*100%*10'000) | 10'000 |

| Redemption | CHF 10'400 | CHF 10'500 | CHF 10'000 |

| Profit / Loss | 4% | 5% | 0% |

| Swiss income tax | Predominantly one-off interest payments (IUP) |

|---|---|

| Swiss withholding tax | No |

| Swiss stamp tax | Yes |

| EU tax on interest | No |

| ZKB Reverse Convertible auf Rheinmetall AG 149281282 / CH1492812826 |

| ZKB EQ Discount-Zertifikat auf Rheinmetall AG 144652793 / CH1446527934 |

| ZKB EQ Discount-Zertifikat auf Rheinmetall AG 149281070 / CH1492810705 |

| ZKB Autocallable Barrier Reverse Convertible auf Arm Holdings Limited 144651964 / CH1446519642 |

| 10.4278% p.a. ZKB Barrier Reverse Convertible, 28.12.2026 auf AMS SE 130397952 / CH1303979525 |