Schnellzugriff

- Direkt zur Sitemap

- Direkt zur Suche

- Direkt zur Startseite

- Direkt zu Zugang für Alle

- Direkt zur Navigation

- Direkt zum Inhalt

- Direkt zum Kontakt

Produkttyp-Nummer gemäss Schweizerischen Verband für Strukturierte Produkte (SVSP): 1130

Die genaue Funktionsweise, Produktdetails und Risiken entnehmen Sie bitte dem Termsheet und dem dazugehörigen Emissionsprogramm.

| Szenario 1 | Szenario 2 | Szenario 3 | |

|---|---|---|---|

| Beschreibung | Steigende Kurse | Leicht steigende Kurse | Fallende Kurse |

| Basiswert | SMI® Index | SMI® Index | SMI® Index |

| Kapitalschutz | 100% | 100% | 100% |

| Partizipation | 100% | 100% | 100% |

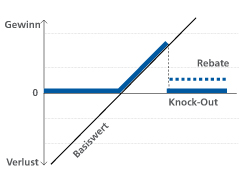

| Knock-out Level (Cap) | 124% | 124% | 124% |

| Rebate | 4% | 4% | 4% |

| Laufzeit | 2 Jahre | 2 Jahre | 2 Jahre |

| Ausgabepreis | 100% | 100% | 100% |

| Eingesetztes Kapital | CHF 10'000 | CHF 10'000 | CHF 10'000 |

| Knock-out während Laufzeit eingetreten? | Ja | Nein | Nein |

| SMI® bei Ausgabe | 8'000 Punkte | 8'000 Punkte | 8'000 Punkte |

| SMI® bei Verfall | 8'800 Punkte | 8'400 Punkte | 7'200 Punkte |

| Performance des SMI® | 10% | 5% | -10% |

| Szenario 1 | Szenario 2 | Szenario 3 | |

|---|---|---|---|

| Berechnung | 10'000 + (4%*10'000) | 10'000 + (5%*100%*10'000) | 10'000 |

| Rückzahlung | CHF 10'400 | CHF 10'500 | CHF 10'000 |

| Gewinn / Verlust | 4% | 5% | 0% |

| Einkommenssteuer | Modifizierte Differenzbesteuerung (IUP) |

|---|---|

| Verrechnungssteuer | Nein |

| Umsatzabgabe | Ja |

| EU-Steuerrückbehalt | Nein |

| ZKB Tracker-Zertifikat Dynamisch auf MGF Natural Resources Basket hCHF 56679022 / CH0566790223 |

| TCBUSZ 110585855 ZKB Tracker-Zertifikat Open End 110585855 / CH1105858554 |

| ZKB Tracker-Zertifikat Dynamisch auf Quantum Computing 121826631 / CH1218266315 |

| ZKB Tracker-Zertifikat auf ZKB MeinIndex Sustainable Energieerzeugung Index 10716403 / CH0107164037 |

| ZKB Tracker-Zertifikat auf XAU/USD Wechselkurs 10716807 / CH0107168079 |