Schnellzugriff

- Direkt zur Sitemap

- Direkt zur Suche

- Direkt zur Startseite

- Direkt zu Zugang für Alle

- Direkt zur Navigation

- Direkt zum Inhalt

- Direkt zum Kontakt

Product type number as specified by the Swiss Structured Products Association (SSPA): 1310

Please consult the termsheet and the accompanying issue prospectus for information on the exact product functionality, product details and risks.

| Scenario 1 | Scenario 2 | Scenario 3 | |

|---|---|---|---|

| Description | Rising underlying | Stagnating underlying | Falling underlying |

| Underlying value | share X | share X | share X |

| Term | 2 years | 2 years | 2 years |

| Issue price | CHF 100 | CHF 100 | CHF 100 |

| Capital employed | CHF 10'000 (100 certificates x CHF 100) | CHF 10'000 (100 certificates x CHF 100) | CHF 10'000 (100 certificates x CHF 100) |

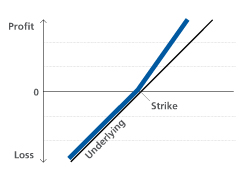

| Participation | 120% | 120% | 120% |

| Share X at initial fixing | CHF 100 | CHF 100 | CHF 100 |

| Share X at maturity | CHF 120 | CHF 100 | CHF 80 |

| Performance share X | 20% | 0% | -20% |

| Scenario 1 | Scenario 2 | Scenario 3 | |

|---|---|---|---|

| Calculation | (120% * 20% * 10'000) + 10'000 | 10'000 | 100 certificates * 80 (equivalent value) |

| Redemption | CHF 12'400 | CHF 10'000 | CHF 8'000 |

| Profit / Loss | 24% | 0% | -20% |

| Swiss income tax | Predominantly one-off interest payments (IUP) |

|---|---|

| Swiss withholding tax | No |

| Swiss stamp tax | Yes (if physical delivery / term > 1 year) |

| EU tax on interest | No |

| ZKB Callable Barrier Reverse Convertible on worst of Alcon AG/Sonova Holding AG/Straumann Holding AG 134141039 / CH1341410392 |

| ZKB Callable Barrier Reverse Convertible on worst of Alcon AG/Sonova Holding AG/Straumann Holding AG 135806162 / CH1358061625 |

| ZKB Callable Barrier Reverse Convertible on worst of Microsoft Corp/Occidental Petroleum Corp/Procte... 151093333 / CH1510933331 |

| ZKB Bonus-Outperformance-Zertifikat Last Look auf einen Basket Barry Callebaut N/Nestlé N 140252016 / CH1402520162 |

| 18.5768% p.a. ZKB Barrier Reverse Convertible, 26.06.2026 on worst of TXN UW/ETSY UN 144651820 / CH1446518206 |