Schnellzugriff

- Direkt zur Sitemap

- Direkt zur Suche

- Direkt zur Startseite

- Direkt zu Zugang für Alle

- Direkt zur Navigation

- Direkt zum Inhalt

- Direkt zum Kontakt

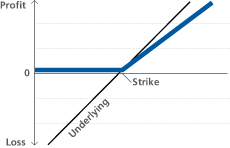

Product type number as specified by the Swiss Structured Products Association (SSPA): 1100

Please consult the termsheet and the accompanying issue prospectus for information on the exact product functionality, product details and risks.

| Scenario 1 | Scenario 2 | Scenario 3 | |

|---|---|---|---|

| Description | Rising underlying | Slightly rising underlying | Falling underlying |

| Underlying value | SMI® Index | SMI® Index | SMI® Index |

| Capital protection | 100% | 100% | 100% |

| Participation | 75% | 75% | 75% |

| Term | 2 years | 2 years | 2 years |

| Issue price | 100% | 100% | 100% |

| Capital employed | CHF 10'000 | CHF 10'000 | CHF 10'000 |

| SMI® at initial fixing | 8'000 points | 8'000 points | 8'000 points |

| SMI® at maturity | 8'800 points | 8'400 points | 7'200 points |

| Performance SMI® | 10% | 5% | -10% |

| Scenario 1 | Scenario 2 | Scenario 3 | |

|---|---|---|---|

| Calculation | 10'000 + (10%*75%*10'000) | 10'000 + (5%*75%*10'000) | 10'000 |

| Redemption | CHF 10'750 | CHF 10'375 | CHF 10'000 |

| Profit / Loss | 7.50% | 3.75% | 0.00% |

| Swiss income tax | Predominantly one-off interest payments (IUP) |

|---|---|

| Swiss withholding tax | No |

| Swiss stamp tax | Yes |

| EU tax on interest | No |

| 5.50% ZKB Reverse Convertible, 08.08.2025 on worst of ALC SE/DAE SE Alcon AG/Daetwyler Holding AG 135804482 / CH1358044829 |

| ZKB Tracker-Zertifikat Dynamisch auf Freigeist Cannabis Opportunity AMC 113976239 / CH1139762392 |

| ZKB Barrier Reverse Convertible on worst of Forbo Holding AG/Daetwyler Holding AG/Lonza Group AG/ABB... 135805715 / CH1358057151 |

| ZKB Autocallable Barrier Reverse Convertible on worst of Baloise-Holding AG/Swiss Life Holding AG/Zu... 134141312 / CH1341413123 |

| 12.10% ZKB Barrier Reverse Convertible, 17.02.2026 on worst of ROG SE/DAE SE/FORN SE Forbo Holding A... 135804774 / CH1358047749 |