Schnellzugriff

- Direkt zur Sitemap

- Direkt zur Suche

- Direkt zur Startseite

- Direkt zu Zugang für Alle

- Direkt zur Navigation

- Direkt zum Inhalt

- Direkt zum Kontakt

Product type number as specified by the Swiss Structured Products Association (SSPA): 1130

Please consult the termsheet and the accompanying issue prospectus for information on the exact product functionality, product details and risks.

| Scenario 1 | Scenario 2 | Scenario 3 | |

|---|---|---|---|

| Description | Rising underlying | Slightly rising underlying | Falling underlying |

| Underlying value | SMI® Index | SMI® Index | SMI® Index |

| Capital protection | 100% | 100% | 100% |

| Participation | 100% | 100% | 100% |

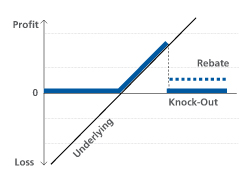

| Knock-out Level (Cap) | 124% | 124% | 124% |

| Rebate | 4% | 4% | 4% |

| Term | 2 years | 2 years | 2 years |

| Issue price | 100% | 100% | 100% |

| Capital employed | CHF 10'000 | CHF 10'000 | CHF 10'000 |

| Barrier breached? | Yes | No | No |

| SMI® at initial fixing | 8'000 points | 8'000 points | 8'000 points |

| SMI® at maturity | 8'800 points | 8'400 points | 7'200 points |

| Performance SMI® | 10% | 5% | -10% |

| Scenario 1 | Scenario 2 | Scenario 3 | |

|---|---|---|---|

| Calculation | 10'000 + (4%*10'000) | 10'000 + (5%*100%*10'000) | 10'000 |

| Redemption | CHF 10'400 | CHF 10'500 | CHF 10'000 |

| Profit / Loss | 4% | 5% | 0% |

| Swiss income tax | Predominantly one-off interest payments (IUP) |

|---|---|

| Swiss withholding tax | No |

| Swiss stamp tax | Yes |

| EU tax on interest | No |

| ZKB Barrier Reverse Convertible on worst of Roche Holding AG/Nestlé AG/Novartis AG/The Swatch Group ... 130398049 / CH1303980499 |

| ZKB Barrier Reverse Convertible auf Idorsia AG 130396615 / CH1303966159 |

| ZKB Autocallable Barrier Reverse Convertible on worst of The Swatch Group AG/Alcon AG/Sandoz Group A... 132910962 / CH1329109628 |

| 9.52% p.a. ZKB Autocallable Barrier Reverse Convertible, 04.03.2025 on worst of UHR SE/ALC SE/SDZ SE... 132910828 / CH1329108281 |

| 11.20% p.a. ZKB Autocallable Reverse Convertible, 12.03.2025 on worst of DBK GY/SAN SQ/ABN NA ABN AM... 132911245 / CH1329112457 |