Schnellzugriff

- Direkt zur Sitemap

- Direkt zur Suche

- Direkt zur Startseite

- Direkt zu Zugang für Alle

- Direkt zur Navigation

- Direkt zum Inhalt

- Direkt zum Kontakt

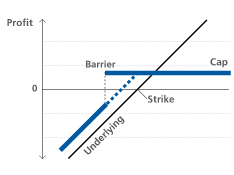

Product type number as specified by the Swiss Structured Products Association (SSPA): 1230

Please consult the termsheet and the accompanying issue prospectus for information on the exact product functionality, product details and risks.

On each Observation Date, the issuer has the right, but not the obligation to call the product and to redeem it on the respective Early Redemption Date. Information flow about redemption is stated in sections "Notices" and will immediately take effect on the Observation Date.

| Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 | |

|---|---|---|---|---|

| Description | Rising underlying | Slightly rising underlying | Slightly falling underlying | Falling underlying |

| Underlying value | share X | share X | share X | share X |

| Term | 1 year | 1 year | 1 year | 1 year |

| Nominal amount | CHF 1'000 | CHF 1'000 | CHF 1'000 | CHF 1'000 |

| Cap Level | 100% | 100% | 100% | 100% |

| Coupon | 8% | 8% | 8% | 8% |

| Knock-in Level (Barrier) | 80% | 80% | 80% | 80% |

| Capital employed | CHF 10'000 (10 BRC a CHF 1'000) | CHF 10'000 (10 BRC a CHF 1'000) | CHF 10'000 (10 BRC a CHF 1'000) | CHF 10'000 (10 BRC a CHF 1'000) |

| Issue price | 100% | 100% | 100% | 100% |

| Ratio | 10 | 10 | 10 | 10 |

| Share X at initial fixing | CHF 100 | CHF 100 | CHF 100 | CHF 100 |

| Share X at maturity | CHF 120 | CHF 102 | CHF 90 | CHF 88 |

| Barrier breached? | No | Yes | No | Yes |

| Performance share X | 20% | 2% | -10% | -12% |

| Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 (physical delivery) | |

|---|---|---|---|---|

| Calculation | (100% + 8%) * 10'000 | (100% + 8%) * 10'000 | (100% + 8%) * 10'000 | [10 BRC * 2 Shares * 88 (equivalent value )] + (8% * 10'000) |

| Redemption | CHF 10'800 | CHF 10'800 | CHF 10'800 | CHF 9'600 |

| Profit / Loss | 8% | 8% | 8% | -4% |

| Swiss income tax | Predominantly one-off interest payments (IUP) |

|---|---|

| Swiss withholding tax | No |

| Swiss stamp tax | Yes (if physical delivery / term > 1 year) |

| EU tax on interest | Yes |

| 10.25% p.a. ZKB Autocallable Barrier Reverse Convertible, 05.12.2025 on worst of TEMN SE/LEON SE/BCV... 132913748 / CH1329137488 |

| ZKB Barrier Reverse Convertible on worst of Leonteq AG/Avolta AG 139434390 / CH1394343904 |

| 16.00% p.a. ZKB Autocallable Reverse Convertible, 11.04.2025 on worst of AMD UW/QCOM UW/AVGO UW Adva... 132912308 / CH1329123082 |

| ZKB Barrier Reverse Convertible on worst of Vontobel Holding AG/Leonteq AG/UBS Group AG/Julius Baer ... 135805287 / CH1358052871 |

| ZKB Callable Barrier Reverse Convertible on worst of Logitech International SA/Leonteq AG 139433972 / CH1394339720 |