Schnellzugriff

- Direkt zur Sitemap

- Direkt zur Suche

- Direkt zur Startseite

- Direkt zu Zugang für Alle

- Direkt zur Navigation

- Direkt zum Inhalt

- Direkt zum Kontakt

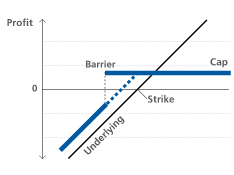

Product type number as specified by the Swiss Structured Products Association (SSPA): 1230

Please consult the termsheet and the accompanying issue prospectus for information on the exact product functionality, product details and risks.

| Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 | |

|---|---|---|---|---|

| Description | Rising underlying | Slightly rising underlying | Slightly falling underlying | Falling underlying |

| Underlying value | share X | share X | share X | share X |

| Term | 1 year | 1 year | 1 year | 1 year |

| Nominal amount | CHF 1'000 | CHF 1'000 | CHF 1'000 | CHF 1'000 |

| Cap Level | 100% | 100% | 100% | 100% |

| Coupon | 8% | 8% | 8% | 8% |

| Knock-in Level (Barrier) | 80% | 80% | 80% | 80% |

| Capital employed | CHF 10'000 (10 BRC a CHF 1'000) | CHF 10'000 (10 BRC a CHF 1'000) | CHF 10'000 (10 BRC a CHF 1'000) | CHF 10'000 (10 BRC a CHF 1'000) |

| Issue price | 100% | 100% | 100% | 100% |

| Ratio | 10 | 10 | 10 | 10 |

| Share X at initial fixing | CHF 100 | CHF 100 | CHF 100 | CHF 100 |

| Share X at maturity | CHF 120 | CHF 102 | CHF 90 | CHF 88 |

| Barrier breached? | No | Yes | No | Yes |

| Performance share X | 20% | 2% | -10% | -12% |

| Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 (physical delivery) | |

|---|---|---|---|---|

| Calculation | (100% + 8%) * 10'000 | (100% + 8%) * 10'000 | (100% + 8%) * 10'000 | [10 BRC * 10 Shares * 88 (equivalent value )] + (8% * 10'000) |

| Redemption | CHF 10'800 | CHF 10'800 | CHF 10'800 | CHF 9'600 |

| Profit / Loss | 8% | 8% | 8% | -4% |

| Swiss income tax | Predominantly one-off interest payments (IUP) |

|---|---|

| Swiss withholding tax | No |

| Swiss stamp tax | Yes (if physical delivery / term > 1 year) |

| EU tax on interest | Yes |

| ZKB Barrier Reverse Convertible auf XPeng Inc 149283220 / CH1492832204 |

| ZKB Autocallable Barrier Reverse Convertible auf Palantir Technologies Inc 147480637 / CH1474806374 |

| ZKB Barrier Reverse Convertible on worst of HelloFresh SE/Delivery Hero SE 144653283 / CH1446532835 |

| ZKB Autocallable Barrier Reverse Convertible on worst of adidas AG/Nike Inc/Under Armour Inc 142529760 / CH1425297608 |

| ZKB Autocallable Barrier Reverse Convertible on worst of Lonza Group AG/Novo Nordisk A/S/Fresenius M... 144652306 / CH1446523065 |