Schnellzugriff

- Direkt zur Sitemap

- Direkt zur Suche

- Direkt zur Startseite

- Direkt zu Zugang für Alle

- Direkt zur Navigation

- Direkt zum Inhalt

- Direkt zum Kontakt

Produkttyp-Nummer gemäss Schweizerischen Verband für Strukturierte Produkte (SVSP): 1300

Die genaue Funktionsweise, Produktdetails und Risiken entnehmen Sie bitte dem Termsheet und dem dazugehörigen Emissionsprogramm.

| Szenario 1 | Szenario 2 | Szenario 3 | |

|---|---|---|---|

| Beschreibung | Steigende Kurse | Stagnierende Kurse | Fallende Kurse |

| Basiswert | 20% Aktie A 20% Aktie B 20% Aktie C 20% D 20% Aktie E |

20% Aktie A 20% Aktie B 20% Aktie C 20% Aktie D 20% Aktie E |

20% Aktie A 20% Aktie B 20% Aktie C 20% Aktie D 20% Aktie E |

| Laufzeit | 5 Jahre | 5 Jahre | 5 Jahre |

| Ausgabepreis | CHF 100 | CHF 100 | CHF 100 |

| Eingesetztes Kapital | CHF 10'000 (100 Zertifikate) | CHF 10'000 (100 Zertifikate) | CHF 10'000 (100 Zertifikate) |

| Basketwert bei Emission | CHF 100 | CHF 100 | CHF 100 |

| Basketwert bei Verfall | CHF 120 | CHF 100 | CHF 80 |

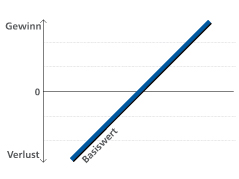

| Basketperformance | 20% | 0% | -20% |

| Szenario 1 | Szenario 2 | Szenario 3 | |

|---|---|---|---|

| Berechnung | 100 Zertifikate * 120 | 100 Zertifikate * 100 | 100 Zertifikate * 80 |

| Rückzahlung | CHF 12'000 | CHF 10'000 | CHF 8'000 |

| Gewinn / Verlust | 20% | 0% | -20% |