Schnellzugriff

- Direkt zur Sitemap

- Direkt zur Suche

- Direkt zur Startseite

- Direkt zu Zugang für Alle

- Direkt zur Navigation

- Direkt zum Inhalt

- Direkt zum Kontakt

Product type number as specified by the Swiss Structured Products Association (SSPA): 1300

Please consult the termsheet and the accompanying issue prospectus for information on the exact product functionality, product details and risks.

| Scenario 1 | Scenario 2 | Scenario 3 | |

|---|---|---|---|

| Description | Rising underlying | Stagnating underlying | Falling underlying |

| Underlying value | 20% share A 20% share B 20% share C 20% D 20% share E |

20% share A 20% share B 20% share C 20% share D 20% share E |

20% share A 20% share B 20% share C 20% share D 20% share E |

| Term | 5 years | 5 years | 5 years |

| Issue price | CHF 100 | CHF 100 | CHF 100 |

| Capital employed | CHF 10'000 (100 Zertifikate) | CHF 10'000 (100 Zertifikate) | CHF 10'000 (100 Zertifikate) |

| Basket at initial fixing | CHF 100 | CHF 100 | CHF 100 |

| Basket at maturity | CHF 120 | CHF 100 | CHF 80 |

| Performance basket | 20% | 0% | -20% |

| Scenario 1 | Scenario 2 | Scenario 3 | |

|---|---|---|---|

| Calculation | 100 Zertifikate * 120 | 100 Zertifikate * 100 | 100 Zertifikate * 80 |

| Redemption | CHF 12'000 | CHF 10'000 | CHF 8'000 |

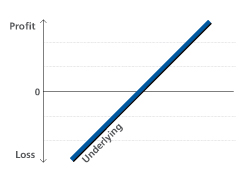

| Profit / Loss | 20% | 0% | -20% |

| ZKB Barrier Reverse Convertible on worst of Goldman Sachs Group Inc/JPMorgan Chase & Co/Morgan S... 147480332 / CH1474803322 |

| ZKB Reverse Convertible auf The Trade Desk Inc 147482666 / CH1474826661 |

| ZKB Autocallable Barrier Reverse Convertible on worst of Qualcomm Inc/Alphabet Inc/The Trade Desk In... 144652632 / CH1446526324 |

| ZKB Autocallable Barrier Reverse Convertible on worst of Eli Lilly & Co/Qualcomm Inc/Alphabet In... 144652537 / CH1446525375 |

| ZKB Reverse Convertible on worst of Marvell Technology Inc/Oracle Corp/The Trade Desk Inc 147480510 / CH1474805103 |