1260 Conditional Coupon Barrier Reverse Convertibles

Product type number as specified by the Swiss Structured Products Association (SSPA): 1260

Please consult the termsheet and the accompanying issue prospectus for information on the exact product functionality, product details and risks.

Market expectations

- Sideways moving or slightly rising underlying

- Falling volatility

- The underlying will not reach or go below a certain level (knock-in level/barrier) during the term

Characteristics

- If the price of the underlying on the observation date is higher than the strike price, the nominal amount plus the coupon is paid out early.

- Opportunity of early repayment with an attractive return.

- Thanks to the risk buffer, this product involves less risk than a direct investment.

- Several underlyings (worst of) permit higher coupons or lower barriers in exchange for greater risk.

- The income accruing on the underlying is used for strategy purposes.

- The profit potential is limited (coupon).

Advantages

- If prices are rising slightly to moderately, repayment and a coupon payment are made early.

- Due to the risk buffer, repayment of the nominal amount is also guaranteed if the performance of the underlying is slightly negative (provided the price of the underlying never touches or falls below the knock-in level).

Disadvantages

- The risk of loss corresponds to that of a direct investment in the underlying.

- If the underlying rises sharply, the return compared with a direct investment is limited.

Repayment terms

- The price of the underlying on the relevant observation date is used to determine the early repayment.

- Amount of the early repayment:

- If the price of the underlying on observation date 1 is the same or higher than the strike price, the Conditional Coupon Barrier Reverse Convertibles is paid out early at the nominal amount plus the single coupon. Otherwise, the certificate continues to run.

- If the price of the underlying on observation date 2 is the same or higher than the strike price and no previous repayment has been made, the Conditional Coupon Barrier Reverse Convertibles is paid out early at the nominal amount plus the double coupon (coupon memory effect). Otherwise, the certificate continues to run.

- Amount of the ordinary repayment:

- If the price of the underlying on final fixing is the same or higher than the exercise price, the Conditional Coupon Barrier Reverse Convertibles is paid out at the nominal amount plus the triple coupon (coupon memory effect).

- If the price of the underlying on final fixing is lower than the strike price but higher than the knock-in level, the nominal amount is repaid.

- If the price of the underlying on final fixing is the same or lower than the knock-in level, repayment is made corresponding to the nominal amount multiplied by the negative performance of the underlying between the initial fixing and final fixing.

Early redemption

Early Redemption is dependent on the Underlying`s price level on the respective Observation Date.

- If the closing price of all Underlyings on the Observation Date trade at or above the Call Level, the product will be redeemed early at 100.00% of the Denomination.

- If one or more Underlyings trades below the Call Level on the Observation Date, the product continues.

Redemption at maturity

If no Early Redemption event has occurred, there are the following possible redemption scenarios:

If the price of none of the Underlyings has traded at or below the Knock-in Level between the Initial Fixing Date and the Final Fixing Date, redemption will be 100% of the Denomination independent of the Final Fixing Levels of the Underlyings. If the price of one or more Ubderlyings has traded at or below the Knock-in Level between Initial Fixing Date and Final Fixing Date,

- redemption will be 100% of the Denomination if the Final Fixing Levels of all Underlyings are at or higher than the Initial Fixing Level or

- the investor will receive a physical delivery of a number of Underlyings as defined in Ratio per Denomination of the worst performing Underlying between Initial Fixing Date and Final Fixing Date(Fractions will be paid in cash,no cumulation).

The Coupon will be paid out on the defined Payment Date(s) independent of the performance of the Underlyings.

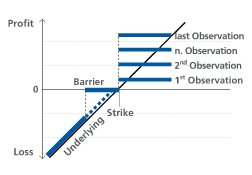

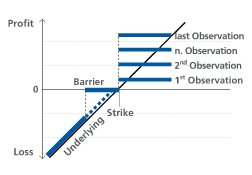

Pay-off diagram upon expiry

Examples upon expiry

Product & scenarios

| |

Scenario 1 |

Scenario 2 |

Scenario 3 |

Scenario 4 |

Szenario 5 |

| Rising underlying |

Slightly rising underlying |

Slightly falling underlying |

Falling underlying |

Falling underlying |

| share X |

share X |

share X |

share X |

share X |

| 3 years |

3 years |

3 years |

3 years |

3 years |

| CHF 1'000 |

CHF 1'000 |

CHF 1'000 |

CHF 1'000 |

CHF 1'000 |

| CHF 100 |

CHF 100 |

CHF 100 |

CHF 100 |

CHF 100 |

| 60% |

60% |

60% |

60% |

60% |

| 8% / 16% / 24% |

8% / 16% / 24% |

8% / 16% / 24% |

8% / 16% / 24% |

8% / 16% / 24% |

| CHF 10'000 (10 certificates a CHF 1'000) |

CHF 10'000 (10 certificates a CHF 1'000) |

CHF 10'000 (10 certificates a CHF 1'000) |

CHF 10'000 (10 certificates a CHF 1'000) |

CHF 10'000 (10 certificates a CHF 1'000) |

| CHF 100 |

CHF 100 |

CHF 100 |

CHF 100 |

CHF 100 |

| CHF 110 |

CHF 98 |

CHF 95 |

CHF 98 |

CHF 91 |

| early redemption |

CHF 110 |

CHF 98 |

CHF 95 |

CHF 84 |

| early redemption |

early redemption |

CHF 105 |

CHF 80 |

CHF 58 |

Payoff

| |

Scenario 1 |

Scenario 2 |

Scenario 3 |

Scenario 4 |

Szenario 5 |

| (100% + 8%) * 10'000 |

(100% + 16%) * 10'000 |

(100% + 24%) * 10'000 |

100% * 10'000 |

(58/100) * 10'000 |

| CHF 10'800 |

CHF 11'600 |

CHF 12'400 |

CHF 10'000 |

CHF 5'800 |

| +8% |

+16% |

+24% |

0% |

-42% |

Taxes

| Predominantly one-off interest payments (IUP) |

| No |

| Yes (if physical delivery / term > 1 year) |

| Yes |