Schnellzugriff

- Direkt zur Sitemap

- Direkt zur Suche

- Direkt zur Startseite

- Direkt zu Zugang für Alle

- Direkt zur Navigation

- Direkt zum Inhalt

- Direkt zum Kontakt

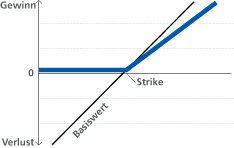

Produkttyp-Nummer gemäss Schweizerischen Verband für Strukturierte Produkte (SVSP): 1100

Die genaue Funktionsweise, Produktdetails und Risiken entnehmen Sie bitte dem Termsheet und dem dazugehörigen Emissionsprogramm.

| Szenario 1 | Szenario 2 | Szenario 3 | |

|---|---|---|---|

| Beschreibung | Steigende Kurse | Leicht steigende Kurse | Fallende Kurse |

| Basiswert | SMI® Index | SMI® Index | SMI® Index |

| Kapitalschutz | 100% | 100% | 100% |

| Partizipation | 75% | 75% | 75% |

| Laufzeit | 2 Jahre | 2 Jahre | 2 Jahre |

| Ausgabepreis | 100% | 100% | 100% |

| Eingesetztes Kapital | CHF 10'000 | CHF 10'000 | CHF 10'000 |

| SMI® bei Ausgabe | 8'000 Punkte | 8'000 Punkte | 8'000 Punkte |

| SMI® bei Verfall | 8'800 Punkte | 8'400 Punkte | 7'200 Punkte |

| Performance des SMI® | 10% | 5% | -10% |

| Szenario 1 | Szenario 2 | Szenario 3 | |

|---|---|---|---|

| Berechnung | 10'000 + (10%*75%*10'000) | 10'000 + (5%*75%*10'000) | 10'000 |

| Rückzahlung | CHF 10'750 | CHF 10'375 | CHF 10'000 |

| Gewinn / Verlust | 7.50% | 3.75% | 0.00% |

| Einkommenssteuer | Modifizierte Differenzbesteuerung (IUP) |

|---|---|

| Verrechnungssteuer | Nein |

| Umsatzabgabe | Ja |

| EU-Steuerrückbehalt | Nein |

| ZKB Callable Barrier Reverse Convertible on worst of Alcon AG/Sonova Holding AG/Straumann Holding AG 134141039 / CH1341410392 |

| ZKB Callable Barrier Reverse Convertible on worst of Alcon AG/Sonova Holding AG/Straumann Holding AG 135806162 / CH1358061625 |

| ZKB Reverse Convertible auf Pinterest Inc 149282342 / CH1492823427 |

| ZKB Reverse Convertible on worst of VAT Group AG/BELIMO Holding AG/ALSO Holding AG 149282677 / CH1492826776 |

| ZKB Barrier Reverse Convertible on worst of Alcon AG/Sandoz Group AG/Sonova Holding AG/Lonza Group A... 140252292 / CH1402522929 |