1230 Barrier reverse convertibles

Product type number as specified by the Swiss Structured Products Association (SSPA): 1230

Please consult the termsheet and the accompanying issue prospectus for information on the exact product functionality, product details and risks.

Market expectations

- Sideways moving or slightly rising underlying

- Falling volatility

- The underlying will not reach or go below a certain level (knock-in level/barrier) during the term

Characteristics

- If the knock-in level is never touched, the nominal amount is repaid.

- If the underlying touches or falls below the knock-in level, the repayment on expiry depends on the level of the underlying. If the underlying is higher than the cap level on expiry, the nominal amount is repaid or the underlying is delivered.

- The coupon is always paid out irrespective of the performance of the underlying.

- Several underlyings (worst of) permit higher coupons or lower barriers in exchange for greater risk.

- The product involves less risk than a direct investment.

- The income accruing on the underlying is used for strategy purposes.

- The profit potential is limited (cap level).

Advantages

- Lower risk of loss than that of a direct investment in the underlying.

- The aim is to generate an excess return in sideways markets when compared to a direct investment in the underlying.

- Due to the risk buffer, repayment of the nominal amount is also guaranteed if the performance of the underlying is slightly negative (provided the price of the underlying never touches or falls below the knock-in level).

Disadvantages

- The risk buffer ceases to apply if the underlying touches or falls below the knock-in level during the term.

- If the underlying rises sharply, the return compared with a direct investment is limited.

Repayment terms

- If the price of the underlying has neither touched nor fallen below the knock-in level during the term:

- the nominal amount is paid out in cash.

- If the price of the underlying has touched or fallen below the knock-in level during the term:

- but is at or above the cap level on expiry, the nominal amount is paid out in cash.

- and is lower than the cap level on expiry, the number of underlyings specified at the start is delivered for each nominal amount and/or a cash settlement is paid out

- The coupon is always paid out irrespective of the performance of the underlying.

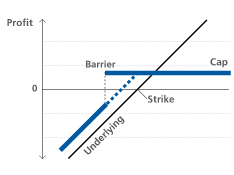

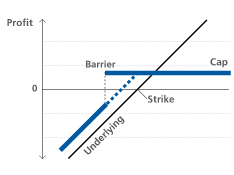

Pay-off diagram upon expiry

Examples upon expiry

Product & scenarios

| |

Scenario 1 |

Scenario 2 |

Scenario 3 |

Scenario 4 |

| Rising underlying |

Slightly rising underlying |

Slightly falling underlying |

Falling underlying |

| share X |

share X |

share X |

share X |

| 1 year |

1 year |

1 year |

1 year |

| CHF 1'000 |

CHF 1'000 |

CHF 1'000 |

CHF 1'000 |

| 100% |

100% |

100% |

100% |

| 8% |

8% |

8% |

8% |

| 80% |

80% |

80% |

80% |

| CHF 10'000 (10 BRC a CHF 1'000) |

CHF 10'000 (10 BRC a CHF 1'000) |

CHF 10'000 (10 BRC a CHF 1'000) |

CHF 10'000 (10 BRC a CHF 1'000) |

| 100% |

100% |

100% |

100% |

| 10 |

10 |

10 |

10 |

| CHF 100 |

CHF 100 |

CHF 100 |

CHF 100 |

| CHF 120 |

CHF 102 |

CHF 90 |

CHF 88 |

| No |

Yes |

No |

Yes |

| 20% |

2% |

-10% |

-12% |

Payoff

| |

Scenario 1 |

Scenario 2 |

Scenario 3 |

Scenario 4 (physical delivery) |

| (100% + 8%) * 10'000 |

(100% + 8%) * 10'000 |

(100% + 8%) * 10'000 |

[10 BRC * 2 Shares * 88 (equivalent value )] + (8% * 10'000) |

| CHF 10'800 |

CHF 10'800 |

CHF 10'800 |

CHF 9'600 |

| 8% |

8% |

8% |

-4% |

Taxes

| Predominantly one-off interest payments (IUP) |

| No |

| Yes (if physical delivery / term > 1 year) |

| Yes |