Schnellzugriff

- Direkt zur Sitemap

- Direkt zur Suche

- Direkt zur Startseite

- Direkt zu Zugang für Alle

- Direkt zur Navigation

- Direkt zum Inhalt

- Direkt zum Kontakt

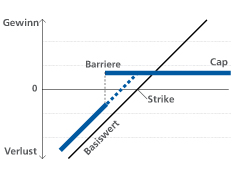

Produkttyp-Nummer gemäss Schweizerischen Verband für Strukturierte Produkte (SVSP): 1230

Die genaue Funktionsweise, Produktdetails und Risiken entnehmen Sie bitte dem Termsheet und dem dazugehörigen Emissionsprogramm.

| Szenario 1 | Szenario 2 | Szenario 3 | Szenario 4 | |

|---|---|---|---|---|

| Beschreibung | Steigende Kurse | Leicht steigende Kurse | Leicht fallende Kurse | Fallende Kurse |

| Basiswert | Aktie X | Aktie X | Aktie X | Aktie X |

| Laufzeit | 1 Jahr | 1 Jahr | 1 Jahr | 1 Jahr |

| Nennbetrag | CHF 1'000 | CHF 1'000 | CHF 1'000 | CHF 1'000 |

| Cap Level | 100% | 100% | 100% | 100% |

| Coupon | 8% | 8% | 8% | 8% |

| Knock-in Level (Barriere) | 80% | 80% | 80% | 80% |

| Eingesetztes Kapital | CHF 10'000 (10 BRC a CHF 1'000) | CHF 10'000 (10 BRC a CHF 1'000) | CHF 10'000 (10 BRC a CHF 1'000) | CHF 10'000 (10 BRC a CHF 1'000) |

| Ausgabepreis | 100% | 100% | 100% | 100% |

| Ratio | 10 | 10 | 10 | 10 |

| Aktie X bei Emission | CHF 100 | CHF 100 | CHF 100 | CHF 100 |

| Aktie X bei Verfall | CHF 120 | CHF 102 | CHF 90 | CHF 88 |

| Knock-in eingetreten? | Nein | Ja | Nein | Ja |

| Aktienperformance | 20% | 2% | -10% | -12% |

| Szenario 1 | Szenario 2 | Szenario 3 | Szenario 4 (Titellieferung) | |

|---|---|---|---|---|

| Berechnung | (100% + 8%) * 10'000 | (100% + 8%) * 10'000 | (100% + 8%) * 10'000 | [10 BRC * 10 Aktien * 88 (Gegenwert )] + (8% * 10'000) |

| Rückzahlung | CHF 10'800 | CHF 10'800 | CHF 10'800 | CHF 9'600 |

| Gewinn / Verlust | 8% | 8% | 8% | -4% |

| Einkommenssteuer | Modifizierte Differenzbesteuerung (IUP) |

|---|---|

| Verrechnungssteuer | Nein |

| Umsatzabgabe | Ja (bei Titellieferung / Überjährigkeit) |

| EU-Steuerrückbehalt | Ja |

| ZKB Barrier Reverse Convertible on worst of Compagnie Financière Richemont SA/Sonova Holding AG/Swis... 139433939 / CH1394339399 |

| ZKB Barrier Reverse Convertible on worst of Sonova Holding AG/Alcon AG/Sandoz Group AG 142529462 / CH1425294621 |

| ZKB Callable Barrier Reverse Convertible on worst of ABB Ltd/Sonova Holding AG/SGS Ltd 134140930 / CH1341409303 |

| ZKB Callable Barrier Reverse Convertible on worst of Alcon AG/Sonova Holding AG/Straumann Holding AG 134141039 / CH1341410392 |

| ZKB Callable Barrier Reverse Convertible on worst of Alcon AG/Sonova Holding AG/Straumann Holding AG 134141644 / CH1341416449 |